Foundations of U.S. Stock Market Structure

A Beginner-Friendly Guide to How the U.S. Stock Market Works

Introduction

If you are new to investing, the us stock market may seem complicated and confusing. Terms like NYSE, NASDAQ, brokers, market makers, and regulation are often mentioned without explanation.

This article explains the foundations of us stock market structure in simple, beginner-friendly language. By the end, you will understand how the us stock market works, who participates, and why market structure matters, even if you have never invested before.

What Is the us stock market?

The us stock market is a system where people buy and sell shares of publicly traded companies. When you buy a stock, you become a partial owner of that company.

The stock market helps:

- Companies raise money to grow

- Investors build wealth

- The economy allocate capital efficiently

What Does “Market Structure” Mean?

Market structure refers to the rules, systems, and participants that make stock trading possible.

It includes:

- Where stocks are traded

- How prices are set

- Who is allowed to trade

- How trades are regulated

Think of market structure as the operating system of the stock market.

Why Market Structure Matters for Beginners

Even beginner investors are affected by market structure because it impacts:

- The price you pay for a stock

- How quickly your trade executes

- Whether you receive a fair price

You don’t need to be an active trader—market structure affects every investor.

Primary Market vs Secondary Market

Primary Market

The primary market is where companies issue new shares to raise money.

Examples include:

- Initial Public Offerings (IPOs)

- Additional stock offerings

Most beginners do not trade directly in the primary market.

Secondary Market

The secondary market is where investors trade existing shares with each other.

If you buy or sell stocks using a brokerage app, you are participating in the secondary market.

Who Regulates the U.S. Stock Market?

The U.S. stock market is regulated to protect investors and maintain trust.

Securities and Exchange Commission (SEC)

The SEC is the main government regulator that:

- Protects investors

- Enforces market rules

- Prevents fraud

Self-Regulatory Organizations

Some organizations help enforce rules, including:

- FINRA (oversees brokers)

- Stock exchanges themselves

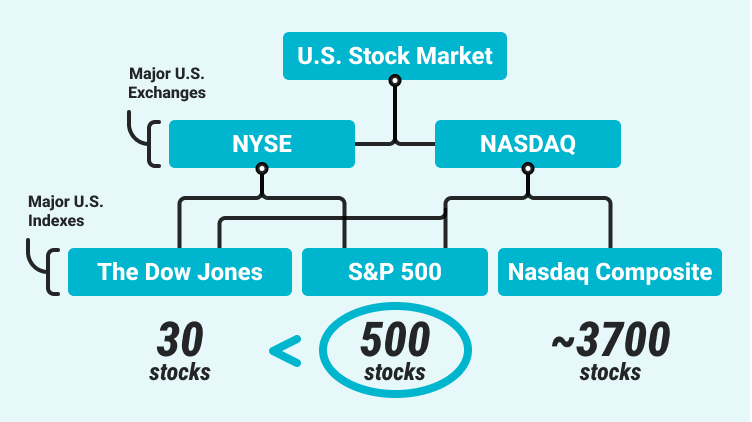

What Are Stock Exchanges?

A stock exchange is an organized marketplace where stocks are traded.

New York Stock Exchange (NYSE)

- One of the oldest exchanges

- Uses both humans and computers

- Home to many large U.S. companies

- Fully electronic exchange

- Known for technology stocks

- Faster, computer-based trading

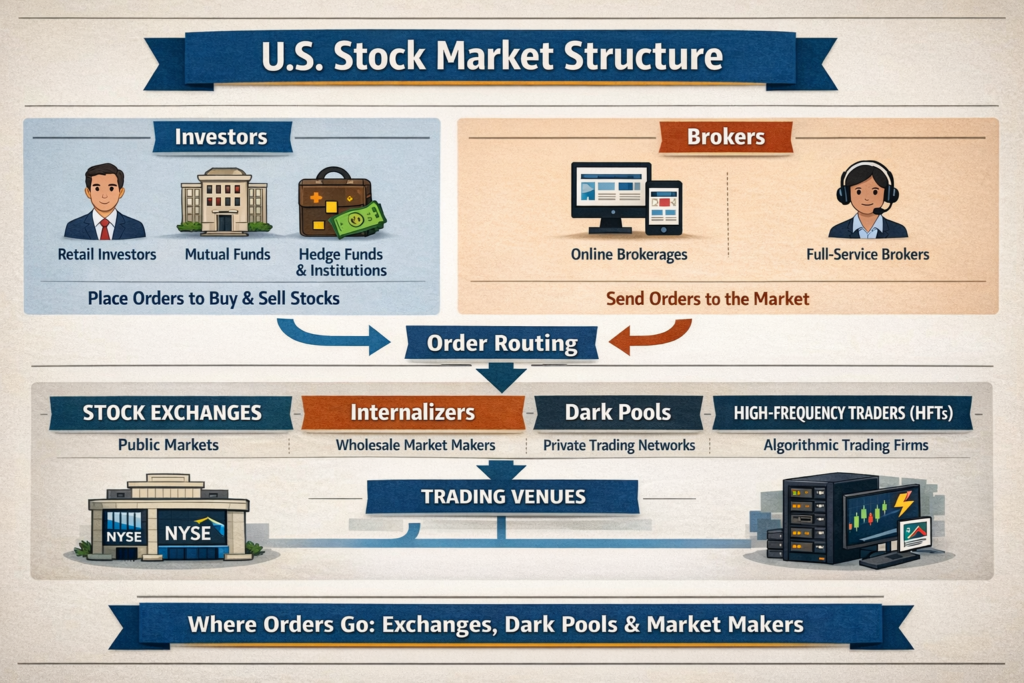

Are All Trades Executed on Exchanges?

No. The U.S. stock market includes multiple trading venues.

Alternative Trading Systems (ATS)

ATS are private platforms where stocks can be traded outside public exchanges.

Dark Pools (Simple Explanation)

Dark pools allow large investors to trade without publicly displaying orders. This reduces price impact but limits transparency.

Who Participates in the U.S. Stock Market?

Retail Investors

Individual investors who trade through brokerage accounts.

Institutional Investors

Large organizations such as:

- Mutual funds

- Pension funds

- Hedge funds

They trade in large volumes and influence prices.

Market Makers

Market makers:

- Always quote buy and sell prices

- Provide liquidity

- Help trades execute quickly

Brokers vs Dealers (Beginner Explanation)

Brokers

- Act on your behalf

- Route your orders to markets

- Aim to get the best available price

Dealers

- Trade using their own money

- Often act as market makers

How a Stock Trade Works (Step by Step)

- You place an order using your broker

- Your broker routes the order

- A matching buyer or seller is found

- The trade executes

- The trade is cleared and settled

This entire process usually happens in milliseconds.

Common Order Types

Market Orders

- Execute immediately

- No price control

Limit Orders

- Execute only at a set price

- Offer more control

What Is NBBO?

NBBO stands for National Best Bid and Offer. It represents the best available prices across all U.S. trading venues.

Brokers are required to try to execute trades at these best prices whenever possible.

Regulation NMS (Simplified)

Regulation NMS is designed to:

- Protect displayed prices

- Promote fair competition

- Improve transparency

It helps ensure investors receive fair pricing regardless of where they trade.

What Is Market Fragmentation?

Market fragmentation means trading is spread across:

- Multiple exchanges

- Private trading venues

- Market makers

Pros

- More competition

- Lower costs

Cons

- More complexity

- Reduced transparency

Clearing and Settlement

Clearing

Confirms that both sides of a trade can meet their obligations.

Settlement

Money and shares officially exchange hands.

Settlement Timeline

- Currently T+1 (one business day after the trade)

What Is Liquidity?

Liquidity refers to how easily a stock can be bought or sold without affecting its price.

Highly liquid stocks:

- Trade easily

- Have smaller price gaps

How Are Stock Prices Determined?

Stock prices are set through supply and demand. Buyers compete to pay more, and sellers compete to accept less. This process is called price discovery.

Role of Technology in U.S. Markets

Most trading today is electronic, allowing:

- Faster execution

- Algorithmic trading

- High market efficiency

Is the U.S. Stock Market Fair?

The U.S. market is heavily regulated and designed to be fair, but debates continue around:

- Speed advantages

- Order routing

- Retail investor protection

Key Takeaways for Beginners

- Market structure is the foundation of all trading

- Every investor is affected by it

- Understanding basics builds confidence

- Knowledge leads to better investment decisions

Conclusion

The foundations of U.S. stock market structure explain how stocks are traded, priced, and regulated. While the system may seem complex, its goal is simple: connect buyers and sellers fairly and efficiently.

For beginners, understanding market structure is a powerful first step toward becoming a confident U.S. investor.

Frequently Asked Questions About U.S. Stock Market Structure

What is the structure of the U.S. stock market?

The U.S. stock market is made up of multiple trading venues where securities are bought and sold. These include major stock exchanges, electronic trading platforms, broker-dealers, market makers, clearinghouses, and regulatory bodies that work together to ensure fair and orderly markets.

What is the difference between the NYSE and NASDAQ?

The New York Stock Exchange (NYSE) uses a hybrid model with both electronic trading and a physical trading floor, while NASDAQ operates entirely through electronic networks. NASDAQ is known for technology and growth-oriented companies, while the NYSE often lists larger, more established firms.

Who regulates the U.S. stock market?

The U.S. stock market is primarily regulated by the Securities and Exchange Commission (SEC). The SEC enforces securities laws, protects investors, and promotes transparency. Other organizations, such as FINRA, help oversee brokers and trading practices.

What role do brokers and market makers play?

Brokers execute trades on behalf of investors, while market makers provide liquidity by continuously offering buy and sell prices. Market makers help ensure that investors can trade efficiently, even during periods of lower market activity.

Why is U.S. stock market structure important for investors?

Understanding market structure helps investors know how trades are executed, how prices are formed, and why costs such as bid-ask spreads exist. This knowledge can improve order placement and reduce unnecessary trading costs.