Primary vs Secondary Markets: Key Differences, Examples, and How They Work .

Understanding how financial markets work is essential for anyone interested in investing, whether you’re a beginner buying your first stock or a seasoned investor diversifying your portfolio. One of the most important distinctions in finance is primary market vs secondary market.

These two markets play different but equally important roles in the U.S. financial system. In this guide, we’ll break down what primary and secondary markets are, how they work, their key differences, real-world examples, and why they matter to investors.

In this guide, we’ll explore the concept of primary market vs secondary market to understand their dynamics better.

What Are Financial Markets?

Financial markets are platforms where buyers and sellers trade financial instruments such as stocks, bonds, derivatives, and mutual funds. In the United States, these markets support:

- Capital formation for businesses

- Investment opportunities for individuals

- Economic growth and financial stability

Financial markets are broadly divided into primary markets and secondary markets, each serving a unique purpose.

What Is the Primary Market?

The primary market is where new securities are created and sold for the first time. When a company or government needs capital, it issues securities directly to investors through the primary market.

Key Characteristics of the Primary Market

- Securities are issued for the first time

- Funds go directly to the issuer

- Prices are usually fixed

- Investors buy securities directly from the issuing entity

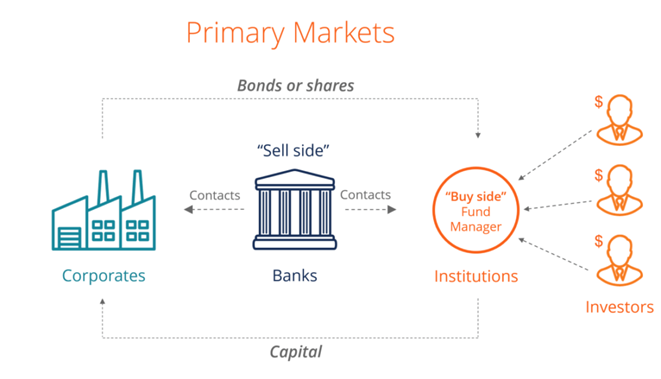

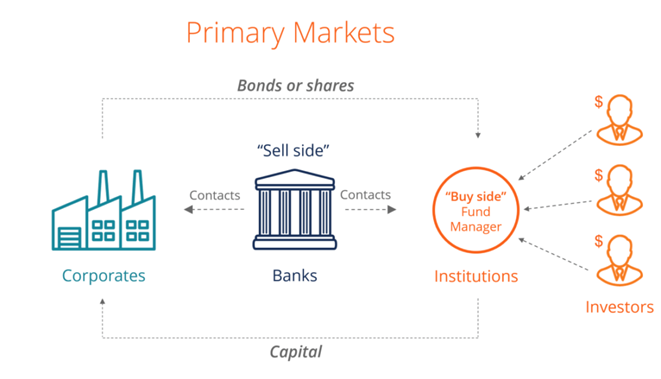

How the Primary Market Works in the U.S.

In the U.S., companies typically work with investment banks to issue securities. The process includes:

- Company decides to raise capital

- Investment banks underwrite the issue

- Regulatory filings with the SEC

- Securities sold to investors

This process ensures transparency, regulatory compliance, and investor protection.

Common Types of Primary Market Issues

Initial Public Offering (IPO)

An IPO occurs when a private company offers its shares to the public for the first time. This is often a major milestone for growing companies.

Example: When a tech startup goes public on a U.S. exchange, investors purchase shares in the primary market during the IPO.

Follow-On Public Offering (FPO)

A Follow-On Public Offering happens when an already public company issues additional shares to raise more capital.

Private Placements

In private placements, securities are sold directly to a small group of institutional or accredited investors instead of the general public.

Rights Issues

Existing shareholders are given the right to buy additional shares at a discounted price before they’re offered to the public.

What Is the Secondary Market?

The secondary market is where previously issued securities are bought and sold among investors. This is what most people think of when they hear the term “stock market.”

Key Characteristics of the Secondary Market

- No new securities are created

- Issuing companies do not receive funds

- Prices fluctuate based on supply and demand

- Provides liquidity and price discovery

How the Secondary Market Works in the U.S.

In the U.S., secondary market trading happens through:

- Stock exchanges

- Electronic trading platforms

- Brokerage firms

When you buy or sell shares through an online broker, you are participating in the secondary market. The transaction occurs between investors, not with the issuing company.

Why the Secondary Market Is Important

The secondary market plays a critical role in the U.S. economy by providing:

Liquidity

Investors can quickly convert securities into cash, making investing less risky and more attractive.

Price Discovery

Prices reflect real-time information, company performance, and investor sentiment.

Market Efficiency

Efficient markets help allocate capital to the most productive uses.

Key Differences Between Primary and Secondary Markets

| Feature | Primary Market | Secondary Market |

| Purpose | Capital formation | Trading & liquidity |

| Securities | New issues | Existing securities |

| Buyer | Investors | Investors |

| Seller | Issuer | Investors |

| Price | Fixed | Market-driven |

| Funds go to | Issuer | Selling investor |

Primary vs Secondary Markets: Real-Life Example

Imagine a U.S.-based company decides to go public:

- During the IPO, investors buy shares directly from the company → Primary Market

- After the IPO, those shares are traded on stock exchanges → Secondary Market

Both markets work together to ensure businesses can raise money and investors can trade efficiently.

How Investors Participate in Each Market

Investing in the Primary Market

Investors can access the primary market through:

- IPO subscriptions

- Rights issues

- Private placements (for accredited investors)

Pros:

- Opportunity to buy at issue price

- Potential for early gains

Cons:

- Limited access

- Risk of overvaluation

Investing in the Secondary Market

Most retail investors participate in the secondary market using brokerage platforms.

Pros:

- High liquidity

- Transparent pricing

- Easy access

Cons:

- Market volatility

- Price fluctuations

Role of Regulation in the U.S. Markets

Both primary and secondary markets in the U.S. are regulated to protect investors and maintain market integrity.

Key regulatory goals include:

- Preventing fraud

- Ensuring transparency

- Promoting fair trading practices

Regulations help build investor confidence and support long-term market growth.

How Primary and Secondary Markets Support Economic Growth

Together, these markets:

- Enable companies to expand and innovate

- Provide investment opportunities for individuals

- Encourage savings and wealth creation

- Strengthen the overall financial system

Without the primary market, companies couldn’t raise capital efficiently. Without the secondary market, investors wouldn’t have liquidity or price transparency.

Which Market Is Better for Investors?

There is no one-size-fits-all answer.

- Long-term investors often prefer the secondary market for stability and diversification.

- Risk-tolerant investors may explore IPOs and other primary market opportunities.

- Institutional investors actively participate in both markets.

Your investment strategy, risk tolerance, and financial goals should guide your choice.

Final Thoughts: Primary Market vs Secondary Markets Explained

The difference between primary market and secondary markets is fundamental to understanding how investing works in the United States. The primary market fuels business growth by creating new securities, while the secondary market ensures liquidity, transparency, and efficiency.

Whether you’re investing in an IPO or trading stocks online, both markets are working behind the scenes to support your financial journey.

Understanding them empowers you to make smarter, more confident investment decisions.

One Reply to “Primary vs Secondary Markets: Key Differences, Examples, and How They Work .”