Futures Contract: An Agreement to Buy or Sell at a Future Date at a Fixed Price

A futures contract is a standardized financial agreement to buy or sell an asset at a predetermined price on a specific future date. Futures are a core part of global financial markets and are widely used by businesses, investors, and traders to manage risk or speculate on price movements. While the concept may sound complex, the basic idea is simple: lock in a price today for a transaction that will happen later.

This beginner-friendly guide explains what futures contracts are, how they work, who uses them, and realistic examples you’ll see in everyday finance.

What Is a Futures Contract?

A futures contract is a legally binding agreement between two parties:

- One party agrees to buy

- The other agrees to sell

- At a fixed price

- On a specific future date

The asset being traded—called the underlying asset—can be a commodity, stock market index, currency, or interest rate.

Simple example:

If oil is trading at $80 per barrel today, a futures contract may allow a buyer and seller to agree now to trade oil at $80 three months from today, regardless of where oil prices move in the meantime.

Why Futures Contracts Exist

Futures contracts were originally created to solve a practical problem: price uncertainty. They allow participants to plan ahead by locking in prices.

Futures are mainly used for:

- Hedging: Reducing risk from price fluctuations

- Speculation: Profiting from price movements

- Price discovery: Helping markets determine fair future prices

Common Underlying Assets in Futures Contracts

Futures contracts exist for many types of assets, including:

- Commodities: Oil, gold, corn, wheat

- Stock indexes: The S&P 500

- Currencies: U.S. dollar, euro, yen

- Interest rates: Treasury bonds and yields

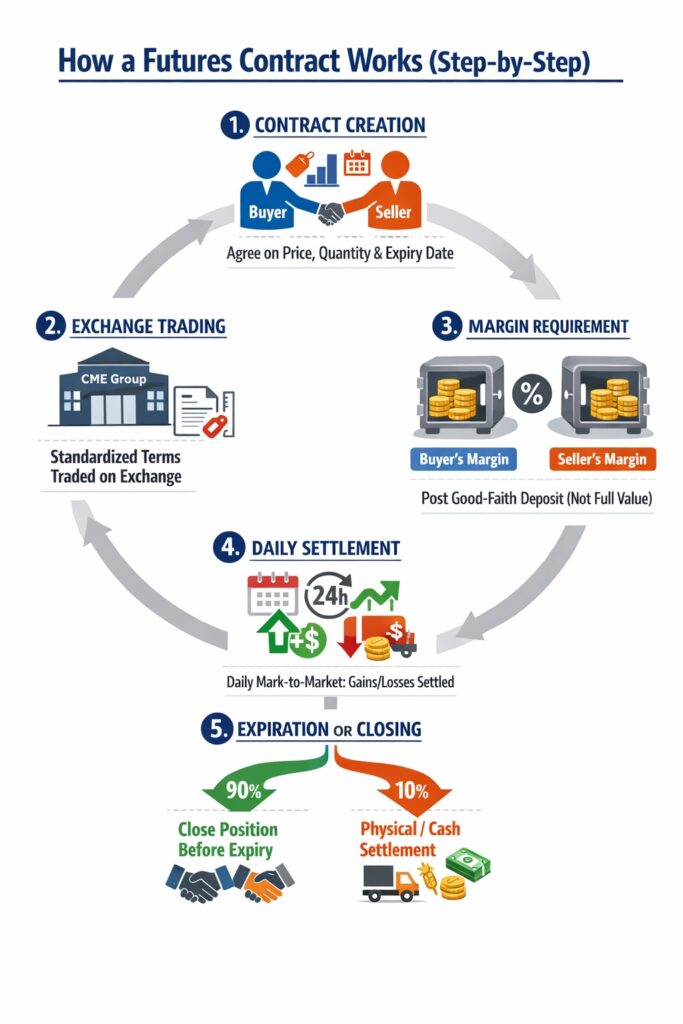

How a Futures Contract Works (Step by Step)

- Contract creation:

A buyer and seller agree on price, quantity, and expiration date. - Exchange trading:

Most futures contracts trade on regulated exchanges such as the CME Group, which standardizes contract terms. - Margin requirement:

Instead of paying the full contract value, traders post a margin deposit, which acts as a good-faith guarantee. - Daily settlement (mark-to-market):

Gains and losses are calculated daily based on price changes. - Expiration or closing:

Most traders close their positions before expiration. Few contracts result in physical delivery.

Real-world example:

A wheat farmer expects to harvest crops in six months. The farmer worries prices might fall. By selling wheat futures today, the farmer locks in a selling price. If prices drop later, losses in the physical market are offset by gains in the futures contract.

Hedging helps businesses stabilize income and manage uncertainty.

Speculation Example: Using Futures to Seek Profit

Speculators use futures to profit from price movements without owning the underlying asset.

Beginner example:

A trader believes oil prices will rise due to increased global demand. The trader buys an oil futures contract. If oil prices rise, the contract gains value and can be sold for a profit. If prices fall, the trader incurs a loss.

Because futures use leverage, both gains and losses can be significant.

Futures vs. Other Financial Instruments

Futures vs. stocks:

- Stocks represent ownership

- Futures are contracts with expiration dates

Futures vs. options:

- Futures create an obligation to buy or sell

- Options provide the right, but not the obligation

Understanding this distinction is crucial for beginners.

Leverage in Futures Contracts

One of the defining features of futures is leverage. Traders control a large contract value with a relatively small margin deposit.

Example:

You might control $100,000 worth of futures with only $10,000 in margin.

Leverage magnifies:

- Potential profits

- Potential losses

Because of this, futures trading requires discipline and risk management.

Do Futures Always Involve Physical Delivery?

No. While some futures contracts allow for physical delivery (such as oil or grain), most traders never intend to take delivery.

Instead, they:

- Close the position before expiration

- Roll the contract into a later month

Financial futures, such as index futures, are settled in cash.

Risks of Futures Contracts

Futures can be powerful tools, but they come with risks:

- High leverage can lead to rapid losses

- Market volatility can trigger margin calls

- Complexity may confuse beginners

That’s why many new traders start by learning how futures work before trading real money.

Who Uses Futures Contracts?

Futures contracts are used by:

- Farmers and energy producers

- Airlines and manufacturers

- Institutional investors and hedge funds

- Professional traders

Even individual investors may gain futures exposure indirectly through ETFs or managed funds.

Are Futures Contracts Right for Beginners?

Futures are not inherently “bad,” but they require education and caution. Beginners should:

- Understand the underlying asset

- Learn about margin and leverage

- Start with simulated trading if possible

- Use strict risk management

Knowledge matters more than speed when learning futures.

Final Thoughts

A futures contract is an agreement to buy or sell an asset at a future date for a fixed price. It plays a critical role in managing risk, discovering prices, and enabling speculation across global markets.

While futures can be complex, the core concept is simple: reduce uncertainty by deciding today what price will apply tomorrow. For beginners willing to learn the fundamentals, futures contracts offer a powerful window into how modern financial markets operate.