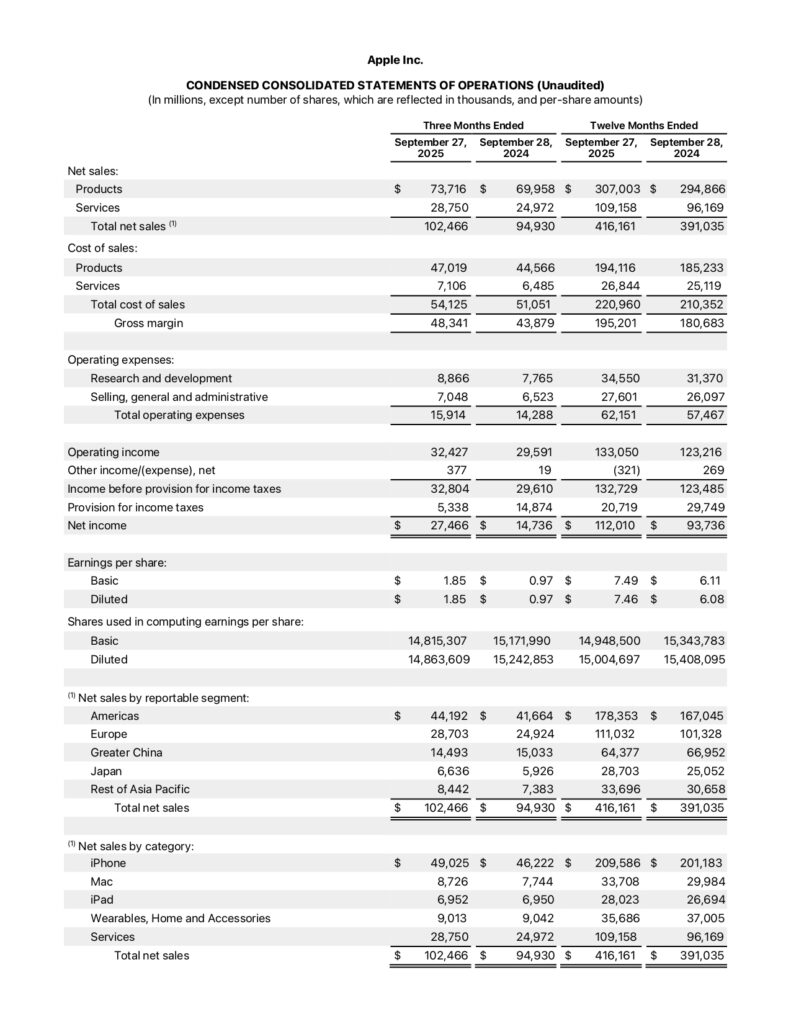

Income Statement: Shows Revenue, Expenses, and Profit

An income statement is a financial report that shows how much money a company earned, how much it spent, and whether it made a profit or loss over a specific period of time. It’s often called a profit and loss statement (P&L) because it summarizes a company’s operating results in a clear, structured way.

For beginner investors, the income statement is usually the easiest financial statement to understand. It answers one essential question: Is this business making money? Learning how to read an income statement helps investors evaluate company performance, compare businesses, and make more informed investment decisions.

Why the Income Statement Matters

The income statement matters because profitability is a key driver of long-term business success. Companies that consistently earn profits are generally better positioned to grow, pay debts, reward shareholders, and survive economic downturns.

Investors use income statements to:

- Evaluate how well a company generates revenue

- Understand cost structure and efficiency

- Track profit trends over time

- Compare companies within the same industry

While stock prices change daily, income statements focus on the underlying business performance behind those price movements.

The Time Period Covered

Unlike the balance sheet, which shows a snapshot at a single moment, the income statement covers a period of time, such as:

- One quarter (three months)

- One year

This makes it useful for spotting trends. Looking at income statements across multiple periods helps investors see whether a company is growing, shrinking, or staying consistent.

The Main Components of an Income Statement

Most income statements follow a similar structure, moving from top-line revenue down to bottom-line profit.

1. Revenue (Top Line)

Revenue is the total amount of money a company earns from selling its products or services. It’s often called the top line because it appears at the top of the income statement.

Example:

If a company sells 100,000 units of a product at $20 each, its revenue is $2 million.

Revenue growth over time usually signals increasing demand or successful expansion. However, revenue alone does not tell the full story—you must also consider costs.

2. Cost of Goods Sold (COGS)

Cost of goods sold represents the direct costs involved in producing the company’s products or services. This may include:

- Raw materials

- Manufacturing labor

- Production-related expenses

Subtracting COGS from revenue gives gross profit.

Example:

Revenue: $2,000,000

COGS: $1,200,000

Gross profit: $800,000

Gross profit shows how efficiently a company produces what it sells.

3. Operating Expenses

Operating expenses are the costs required to run the business that are not directly tied to production. Common operating expenses include:

- Salaries and wages

- Rent and utilities

- Marketing and advertising

- Research and development

After subtracting operating expenses from gross profit, you get operating income.

Operating income reflects how well management controls everyday business costs.

4. Operating Income (Operating Profit)

Operating income shows profit from core business activities before interest and taxes. Many investors consider this one of the most important figures because it focuses on the company’s main operations.

A growing operating income over time often signals a strong and scalable business model.

5. Other Income and Expenses

Some income statements include items not related to core operations, such as:

- Interest income

- Interest expense

- Gains or losses from asset sales

These items can affect profits but may not reflect ongoing business performance.

6. Net Income (Bottom Line)

Net income is the final profit after all expenses, interest, and taxes are deducted. It’s often called the bottom line.

Example:

If a company earns $300,000 in operating income but pays $50,000 in interest and $70,000 in taxes, its net income is $180,000.

Positive net income means the company made a profit. Negative net income means it reported a loss.

A Simple Income Statement Example

Here’s a simplified example for a small business over one year:

- Revenue: $1,000,000

- Cost of goods sold: $600,000

- Gross profit: $400,000

- Operating expenses: $250,000

- Operating income: $150,000

- Taxes and interest: $40,000

- Net income: $110,000

This breakdown shows exactly where the money came from and where it went.

How Investors Use Income Statements

Investors use income statements to:

- Track revenue and profit growth

- Compare profitability between companies

- Identify rising costs or shrinking margins

- Evaluate business efficiency

For example, two companies may have similar revenue, but the one with higher net income is usually operating more efficiently.

Common Income Statement Ratios

Income statements are often used to calculate key ratios, such as:

- Profit margin: Net income ÷ revenue

- Gross margin: Gross profit ÷ revenue

- Operating margin: Operating income ÷ revenue

Higher margins often indicate stronger pricing power or better cost control.

Income Statement Limitations

While valuable, income statements have limitations:

- They reflect past performance, not guaranteed future results

- Accounting choices can affect reported profits

- One-time events can temporarily distort numbers

This is why income statements should be reviewed alongside balance sheets and cash flow statements.

Income Statements and Long-Term Investing

For long-term investors, income statements help identify companies with sustainable profitability. Businesses that grow revenue while maintaining healthy margins are often better positioned for long-term success.

Income statements also help investors stay grounded during market volatility. If the business continues to perform well, short-term stock price declines may be less concerning.

Tips for Beginners Reading Income Statements

To get started:

- Focus on trends, not one-time results

- Compare companies within the same industry

- Watch for consistent revenue and profit growth

- Look beyond revenue to expenses and margins

You don’t need to analyze every line item to gain useful insight.

Final Thoughts

The income statement is a financial report that shows a company’s revenue, expenses, and profit over a period of time. It provides a clear view of how well a business operates and whether it is financially successful.

For beginners, learning to read an income statement is a major step toward confident investing. By understanding how revenue turns into profit—and where money is spent along the way—investors can make smarter decisions, evaluate company performance more accurately, and build a stronger foundation for long-term financial success.

3 Replies to “Income Statement: Shows Revenue, Expenses, and Profit”