What Is Market Psychology? How Investor Emotions Drive Stock Prices

When people think about the stock market, they often imagine numbers, charts, earnings reports, and economic data driving prices. While these factors matter, they are only part of the story. In reality, market psychology—the collective emotions, beliefs, and behaviors of investors—plays a powerful role in how stock prices move.

Understanding market psychology helps explain why markets sometimes rise even when fundamentals look weak, or fall sharply despite strong company performance. For beginners, learning how emotions influence markets can be just as important as learning financial terms or investment strategies.

What Is Market Psychology?

Market psychology refers to the overall emotional state of investors and how those emotions influence buying and selling decisions in financial markets. Since markets are made up of millions of individual participants—each with their own fears, hopes, and expectations—prices often reflect emotion as much as logic.

Instead of moving strictly based on a company’s true value, stock prices are influenced by:

- Investor expectations about the future

- Reactions to news and headlines

- Fear of losses and desire for gains

- Crowd behavior and social influence

In the short term, emotions can dominate rational analysis, causing prices to move quickly and sometimes unpredictably.

Why Emotions Matter More Than You Think

Every trade represents a decision made by a human or an algorithm designed by a human. Even professional investors are influenced by emotions, especially during periods of uncertainty or extreme market movement.

Emotions matter because they:

- Amplify price swings

- Create market trends and bubbles

- Cause overreactions to news

- Lead investors to buy or sell at poor times

When many investors feel the same emotion at once—such as fear during a crash or excitement during a rally—those feelings can push prices far from their underlying value.

The Two Primary Emotions Driving Markets: Fear and Greed

At the heart of market psychology are two dominant emotions that influence most investment decisions.

Greed: The Desire for Profit

Greed appears when prices are rising and optimism is high. Investors start believing:

- “This stock will keep going up”

- “I don’t want to miss out”

- “Everyone else is making money”

Greed can lead to:

- Overconfidence

- Ignoring risk

- Buying at inflated prices

During greedy periods, investors often focus on potential gains while downplaying warning signs.

Fear: The Desire to Avoid Loss

Fear takes over when markets fall or uncertainty increases. Investors worry about:

- Losing their money

- Making the wrong decision

- Market crashes or economic trouble

Fear often leads to:

- Panic selling

- Selling at market lows

- Avoiding investing altogether after losses

Just as greed can push prices too high, fear can push them too low.

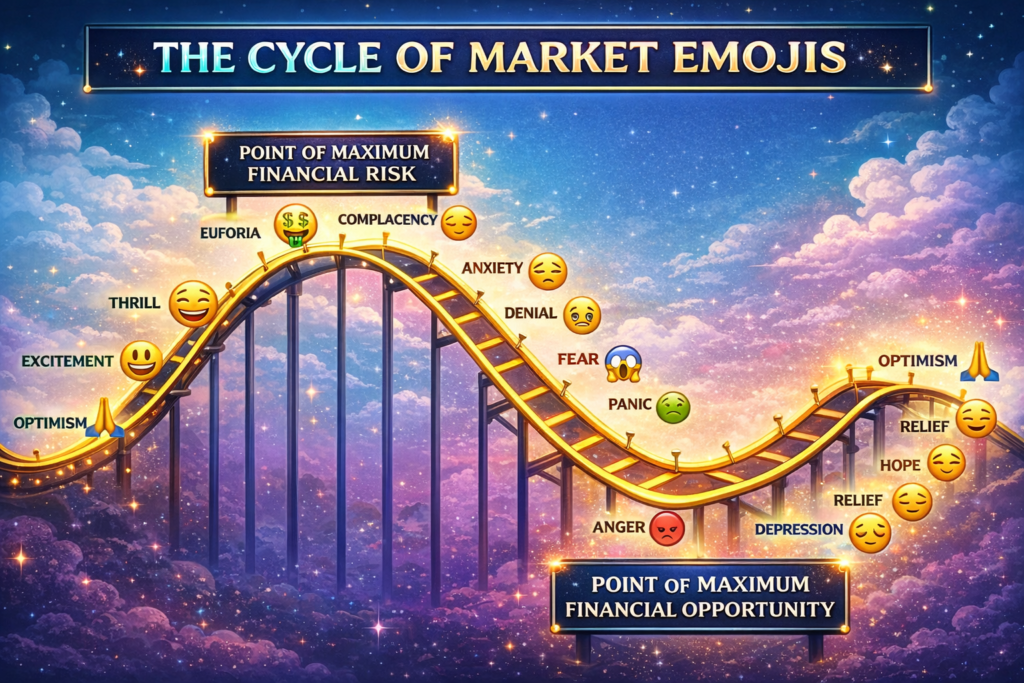

The Emotional Cycle of the Stock Market

Market psychology tends to follow a repeating emotional cycle. While the timing and intensity vary, the pattern is surprisingly consistent.

1. Optimism

Investors feel hopeful. Prices rise steadily, and confidence builds.

2. Excitement

More investors enter the market. Risk-taking increases, and positive news dominates.

3. Euphoria

Prices rise rapidly. Everyone seems to be making money. Caution disappears.

This phase often marks market tops and bubbles.

4. Anxiety

Prices stop rising. Volatility increases. Investors become uneasy.

5. Fear

Losses grow. Negative news gains attention. Confidence declines.

6. Panic

Selling accelerates as investors rush to exit positions.

7. Despair

Sentiment is extremely negative. Many investors give up on the market.

Ironically, this stage often presents the best long-term buying opportunities.

Herd Mentality: Why Investors Follow the Crowd

One of the strongest forces in market psychology is herd mentality—the tendency for people to follow what others are doing instead of thinking independently.

Investors often assume:

- “So many people can’t be wrong”

- “If everyone is buying, it must be safe”

- “If everyone is selling, I should sell too”

Herd behavior can drive prices far above or below fair value. Social media, financial news, and online forums amplify this effect by spreading emotions quickly.

Fear of Missing Out (FOMO) in Investing

FOMO, or fear of missing out, is closely related to herd mentality. It occurs when investors worry they will miss potential profits if they don’t act quickly.

FOMO can cause investors to:

- Buy after large price increases

- Ignore valuation and risk

- Enter investments late in a trend

Many investors buy near market peaks not because fundamentals justify it, but because they fear being left behind.

Overconfidence and the Illusion of Control

Overconfidence is a common psychological bias where investors believe they are more skilled at predicting the market than they actually are.

This bias can lead to:

- Excessive trading

- Concentrated investments

- Ignoring opposing viewpoints

Closely related is the illusion of control, where investors believe they can predict or manage outcomes that are largely uncertain. Early success—often driven by luck—can reinforce this false confidence.

Loss Aversion: Why Losses Hurt More Than Gains Feel Good

Psychological research shows that losses feel significantly more painful than gains feel pleasurable. This concept is known as loss aversion.

In investing, loss aversion causes people to:

- Hold losing investments too long

- Sell winning investments too early

- Avoid investing after experiencing losses

Loss aversion explains why many investors underperform the market despite investing in quality assets.

Confirmation Bias: Seeing Only What You Want to See

Confirmation bias occurs when investors seek information that supports their existing beliefs and ignore information that contradicts them.

For example:

- Bullish investors focus only on positive news

- Bearish investors focus only on negative headlines

This bias reinforces emotional decision-making and makes it harder to reassess positions objectively.

How News and Media Shape Market Psychology

Markets react quickly to news, but not always rationally. Headlines often emphasize dramatic or emotional narratives, which can intensify investor reactions.

- Negative news tends to trigger fear and fast selling

- Positive news can fuel excitement and speculative buying

Markets frequently overreact in the short term and correct later as emotions settle and fundamentals regain focus.

A Realistic Example of Market Psychology

Consider a beginner investor named Mark.

- During a strong bull market, Mark sees stock prices rising daily.

- Friends talk about quick profits.

- Media coverage is optimistic.

Mark invests heavily near the top.

Later:

- The market declines sharply.

- News turns negative.

- Fear spreads.

Mark panics and sells at a loss, only to watch the market recover months later. This common experience shows how emotions—not poor intelligence—often drive bad decisions.

Market Psychology vs. Fundamentals

Fundamentals focus on business value—earnings, cash flow, growth, and financial strength.

Market psychology focuses on perception, emotion, and reaction.

- Short term: Psychology often dominates

- Long term: Fundamentals matter more

Understanding this difference helps investors avoid reacting emotionally to short-term price movements.

Why Beginners Are Especially Affected

New investors are more vulnerable to market psychology because they:

- Lack experience with market cycles

- React strongly to short-term losses

- Overestimate short-term trends

- Feel pressure to act quickly

Experience doesn’t remove emotions, but it helps investors recognize patterns and respond more calmly.

How to Manage Market Psychology as an Investor

You can’t eliminate emotions, but you can manage them.

1. Have a Clear Plan

A defined investment strategy reduces impulsive decisions.

2. Focus on Long-Term Goals

Short-term fluctuations matter less when investing for years, not weeks.

3. Diversify

Diversification reduces emotional stress during volatility.

4. Limit Market Noise

Constantly checking prices and headlines increases anxiety.

5. Learn From History

Markets have always experienced fear and greed—and recovered.

The Role of Behavioral Finance

Behavioral finance is the field that studies how psychological biases affect financial decisions. It challenges the idea that markets are always rational and explains why emotional patterns repeat over time.

Key insights include:

- Investors are predictably irrational

- Emotional discipline is a competitive advantage

- Understanding bias improves decision-making

Can Market Psychology Be Used to Your Advantage?

Yes. Many successful investors don’t try to predict emotions perfectly. Instead, they:

- Stay calm when others panic

- Remain cautious during extreme optimism

- Focus on long-term value rather than hype

This approach reduces costly mistakes and improves consistency over time.

Why Market Psychology Matters for Long-Term Success

Markets will always involve uncertainty. Emotions will always be present. The difference between successful and unsuccessful investors often comes down to emotional control, not intelligence.

Understanding market psychology helps investors:

- Avoid panic selling

- Resist hype-driven buying

- Stay invested during volatility

- Make decisions based on logic rather than fear

Final Thoughts

Market psychology explains why stock prices move the way they do—and why markets don’t always behave logically in the short term. Fear, greed, herd mentality, overconfidence, and cognitive biases repeatedly influence investor behavior, shaping market trends and price movements.

For beginner investors, understanding how emotions drive stock prices is a powerful advantage. While you can’t control the market, you can control how you respond to it. By recognizing emotional patterns and managing your reactions, you position yourself to invest with greater confidence, discipline, and long-term success.

In the end, mastering market psychology may be just as important as mastering financial knowledge.