If you’re investing or trading in the US stock market, there’s one concept that affects every decision you make—whether you realize it or not:

Risk tolerance.

Risk tolerance is how much risk you can handle emotionally and financially. It’s the level of uncertainty, price movement, and potential loss you can live with—without panicking, making impulsive decisions, or putting your financial future in danger.

Understanding your risk tolerance is one of the smartest moves you can make as a beginner because it helps you choose the right investments, avoid emotional mistakes, and build a strategy you can stick with long-term.

In this guide, we’ll break risk tolerance down in simple terms, explain why it matters so much in the US market, and show realistic examples of how to apply it in real investing and trading situations.

What Is Risk Tolerance?

Risk tolerance is the amount of risk you can handle in your investments or trades before it starts affecting your decisions and your life.

It has two parts:

✅ Emotional Risk Tolerance

This is how you feel when prices move up and down.

Examples:

- Can you stay calm during a market drop?

- Do you panic when you see red in your portfolio?

- Do you constantly check your account?

✅ Financial Risk Tolerance

This is your real-life ability to handle losses without harming your financial goals.

Examples:

- Would a 20% loss delay your retirement?

- Would a big drawdown force you to sell investments?

- Can you still pay bills if the market drops?

A lot of people think risk tolerance is just emotional, but both sides matter equally.

Why Risk Tolerance Matters in the US Stock Market

The US stock market is one of the best long-term wealth-building tools, but it comes with volatility.

Even the strongest markets have pullbacks:

- 5% drops happen often

- 10% corrections are normal

- 20% bear markets happen occasionally

If your portfolio is too risky for your personal risk tolerance, you may:

- panic sell at the bottom

- stop investing completely

- chase “safe” assets too late

- lose trust in the market

So risk tolerance isn’t just a personal preference—it directly affects your results.

Risk Tolerance vs Risk Capacity (Important Difference)

Many beginners confuse these two:

Risk Tolerance (Emotion + Behavior)

“How much risk can I handle before I panic?”

Risk Capacity (Financial Reality)

“How much risk can I afford to take?”

Example:

You might feel comfortable taking big risks (high tolerance), but if you’re using money needed for rent next month, your risk capacity is low.

Or you might have high income and savings (high risk capacity), but you feel anxious during small market drops (low emotional tolerance).

The best strategy matches both.

Common Risk Tolerance Levels (Simple Categories)

1) Conservative Risk Tolerance

You prefer stability and lower volatility.

- You don’t like seeing big swings in your account

- You value capital preservation

Common choices:

- bonds

- dividend-focused ETFs

- balanced portfolios

- large-cap index funds with lower risk

2) Moderate Risk Tolerance

You can handle normal market ups and downs.

- You understand downturns happen

- You can stay invested long-term

Common choices:

- diversified index funds (S&P 500)

- mix of stocks and bonds

- target-date retirement funds

3) Aggressive Risk Tolerance

You can handle major volatility and drawdowns.

- You accept large swings for higher potential returns

- You stay disciplined even during bear markets

Common choices:

- growth stocks

- sector ETFs

- small-cap stocks

- long-term high-equity portfolios

Aggressive doesn’t mean reckless—it means you can handle volatility without emotional decisions.

Realistic Examples of Risk Tolerance in Action

Example 1: A Beginner Investor With Low Risk Tolerance

Sarah is 29 and just started investing. She puts $5,000 into the market.

Two weeks later:

- her portfolio drops to $4,500

She feels stressed, checks her app constantly, and sells everything to stop the pain.

This doesn’t mean investing is “bad.” It means her portfolio was likely too aggressive for her risk tolerance.

A better approach for her might be:

- a diversified ETF portfolio

- auto-investing monthly

- less focus on daily prices

Example 2: A Long-Term Investor With Moderate Risk Tolerance

James invests through his 401(k) every paycheck and focuses on retirement.

During market downturns, he continues investing because:

- he understands the long-term trend

- he doesn’t need the money soon

- he expects volatility

This is moderate risk tolerance—steady, calm, and consistent.

Example 3: A Trader With High Risk Tolerance but Low Risk Control

Mike likes aggressive trading. He’s emotionally fine with volatility.

But he risks too much per trade and has large drawdowns.

This is important:

High risk tolerance is not enough—you still need strong risk management.

Signs Your Risk Tolerance Is Too Low for Your Portfolio

If you feel any of these frequently, your portfolio may be too risky for you:

- you lose sleep when the market drops

- you panic sell during red days

- you check your portfolio every hour

- you feel regret after buying stocks

- you constantly switch strategies

- you feel “relief” when you sell

A portfolio should support your life—not control your emotions.

How to Measure Your Risk Tolerance (Simple Self-Test)

Ask yourself these questions:

- If my portfolio drops 10%, how would I feel?

- If my portfolio drops 20%, would I sell?

- Do I need this money in the next 1–3 years?

- Can I afford to wait for recovery?

- How stable is my income?

- Do I have an emergency fund?

- Have I experienced a bear market before?

Your answers show your emotional and financial tolerance.

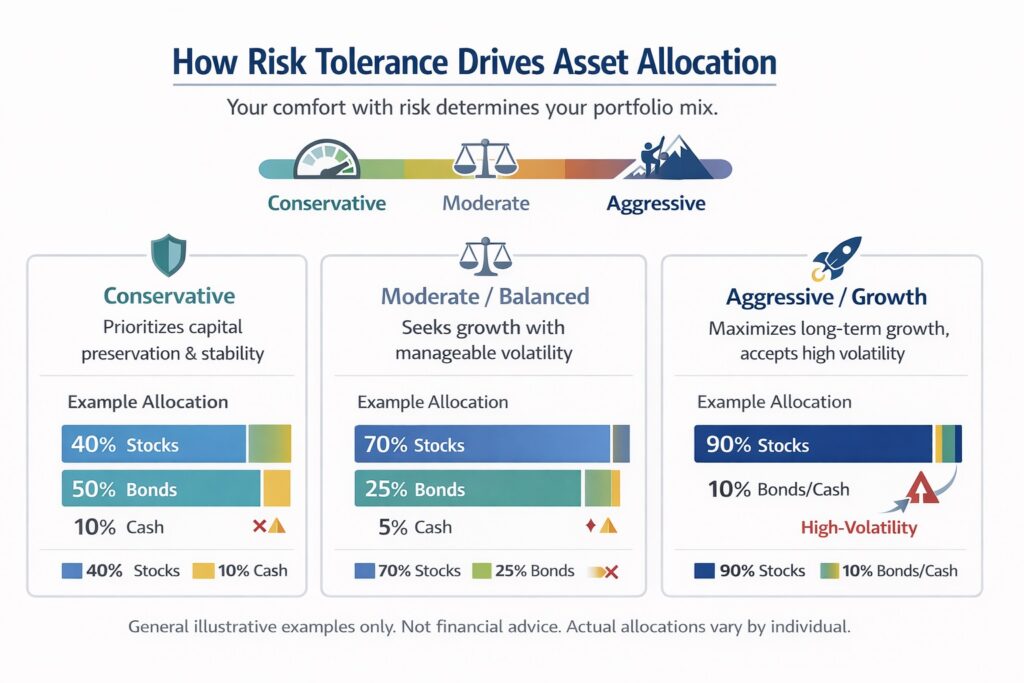

How Risk Tolerance Affects Asset Allocation

Your risk tolerance impacts how much you should allocate to:

- stocks

- bonds

- cash

- high-volatility investments (like options)

Conservative Example Allocation

- 40% stocks

- 50% bonds

- 10% cash

Moderate Example Allocation

- 70% stocks

- 25% bonds

- 5% cash

Aggressive Example Allocation

- 90% stocks

- 10% bonds/cash

These are general examples—not financial advice—but they show how risk tolerance shapes a portfolio.

Risk Tolerance for Trading vs Investing

Risk tolerance applies differently depending on your approach.

Long-Term Investing

Risk is mostly about:

- long-term volatility

- staying invested through downturns

- avoiding panic decisions

Long-term investors can often handle risk better if they have time.

Active Trading

Risk is more immediate:

- daily price swings

- stop-loss execution

- short-term losses

- emotional pressure

Traders may need stricter risk rules because mistakes happen faster.

How to Improve Risk Tolerance Over Time (Yes, It Can Grow)

Risk tolerance is not fixed. Many investors develop higher tolerance as they gain experience.

Ways to build healthy risk tolerance:

✅ Start with smaller amounts

✅ Use diversified ETFs

✅ Learn how the market cycles work

✅ Practice staying invested during small pullbacks

✅ Avoid all-in bets

✅ Focus on long-term goals

Over time, market drops feel less scary because you understand they’re normal.

How to Match Your Risk Tolerance With the Right Strategy

Here’s a simple approach:

If you have low risk tolerance:

- avoid high-volatility stocks

- focus on diversified ETFs

- use balanced portfolios

- invest automatically and ignore short-term noise

If you have moderate risk tolerance:

- invest mostly in broad market ETFs

- add some growth and dividend exposure

- rebalance yearly

- stay consistent

If you have high risk tolerance:

- you can explore growth stocks or sector exposure

- still use risk controls (position sizing, limits)

- avoid reckless leverage

- stay disciplined during drawdowns

Risk tolerance should guide your strategy—not your emotions.

Final Thoughts: Risk Tolerance Protects You From Emotional Mistakes

Risk tolerance is how much risk you can handle emotionally and financially. If your investing strategy doesn’t match your personal risk tolerance, you’ll likely make decisions based on fear or excitement—and that hurts long-term returns.

The best investing plan is not the most aggressive one. It’s the one you can follow consistently, through good markets and bad.

When you understand your risk tolerance, you make smarter choices, avoid panic selling, and build wealth with confidence in the US stock market.

Frequently Asked Questions About Risk Tolerance

What is risk tolerance in investing?

Risk tolerance is your ability to handle investment losses both emotionally and financially without making poor decisions. It reflects how you react to market drops and whether losses would impact important goals like paying bills, saving for retirement, or funding short-term needs.

Why is risk tolerance important in the stock market?

Risk tolerance is important because the stock market is volatile. If your portfolio takes more risk than you can handle, you may panic sell, stop investing, or abandon your strategy during downturns—reducing long-term returns even in strong markets.

What is the difference between risk tolerance and risk capacity?

Risk tolerance is emotional and behavioral—it measures how much volatility you can handle without panicking. Risk capacity is financial—it measures how much loss you can afford based on income, savings, and time horizon. A strong investment strategy must align with both.

How do I know if my portfolio is too risky for me?

Your portfolio may be too risky if you lose sleep during market drops, check your account constantly, panic sell during red days, feel relief after selling, or frequently switch strategies. These behaviors often signal a mismatch between your portfolio and your risk tolerance.

Can risk tolerance change over time?

Yes. Risk tolerance often improves with experience. Starting with smaller investments, using diversified ETFs, learning how market cycles work, and staying invested through normal pullbacks can help you build confidence and handle volatility more calmly.

2 Replies to “Risk Tolerance Explained: How Much Risk You Can Handle Emotionally and Financially”