Cash Flow Statement: Shows Cash Inflows and Outflows

A cash flow statement is a financial report that shows how cash moves into and out of a company during a specific period of time. In simple terms, it tracks where a company’s cash comes from and how it is spent. For beginner investors, the cash flow statement is especially important because it reveals whether a business actually generates cash—not just accounting profits.

While income statements show profits and balance sheets show financial position, the cash flow statement answers a practical question: Does this company have enough cash to operate, pay its bills, and grow? Understanding this statement helps investors avoid companies that look profitable on paper but struggle with real-world cash problems.

Why the Cash Flow Statement Matters

Cash is the lifeblood of any business. Even profitable companies can fail if they don’t manage cash well. The cash flow statement highlights this reality by focusing on actual money movement rather than accounting estimates.

Investors use cash flow statements to:

- Evaluate a company’s ability to generate cash

- Assess financial flexibility and liquidity

- Understand how profits turn into real money

- Spot warning signs of financial stress

For long-term investing, consistent and healthy cash flow is often a sign of a strong, sustainable business.

Cash Flow vs. Profit: Why They’re Different

A common beginner mistake is assuming profit and cash flow are the same. They are not.

- Profit includes revenues and expenses recorded on an accounting basis

- Cash flow tracks actual cash received and paid

Example:

A company may record a sale today but not receive payment for 60 days. The income statement shows revenue immediately, but the cash flow statement shows the cash only when it’s collected.

This difference is why a company can report profits but still struggle to pay bills.

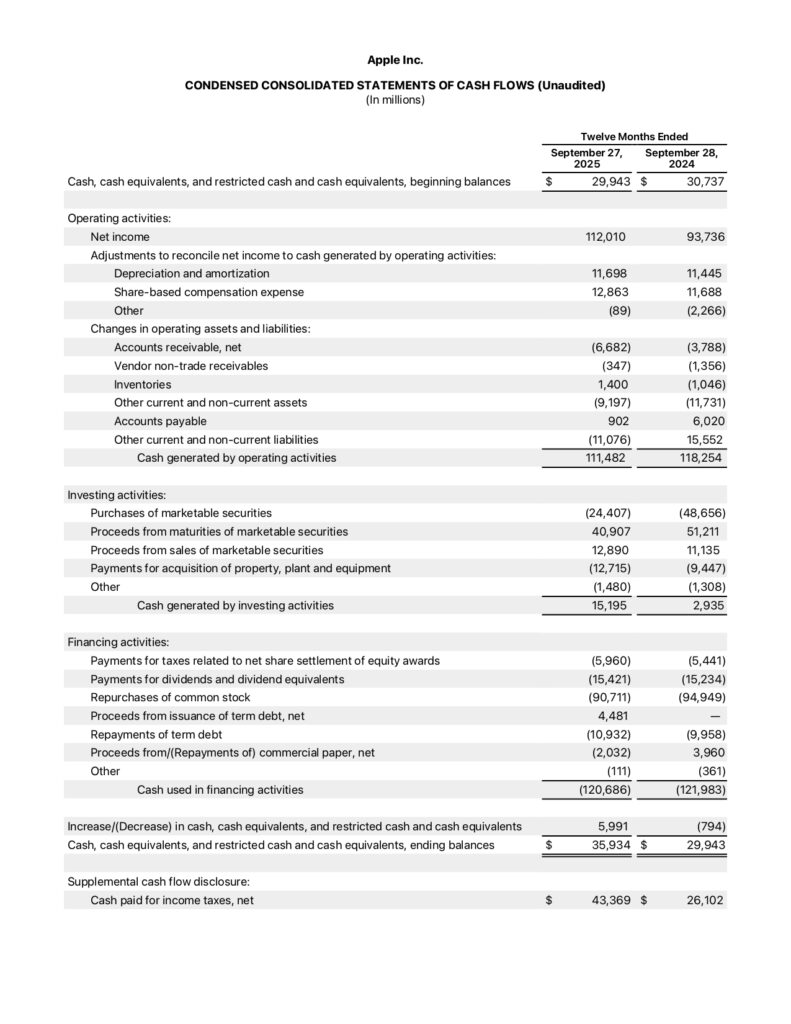

The Three Sections of a Cash Flow Statement

The cash flow statement is divided into three main sections:

- Operating activities

- Investing activities

- Financing activities

Each section highlights a different aspect of how cash moves through the business.

1. Cash Flow From Operating Activities

Operating cash flow shows cash generated or used by a company’s core business operations. This section is often considered the most important.

It includes cash from:

- Customer payments

- Payments to suppliers and employees

- Rent, utilities, and operating expenses

Beginner example:

If a company sells products and collects $500,000 from customers, then pays $350,000 for inventory, wages, and rent, its operating cash flow is $150,000.

Positive operating cash flow indicates the company’s core business generates enough cash to sustain itself.

2. Cash Flow From Investing Activities

Investing cash flow reflects cash spent on or received from long-term investments.

This includes:

- Buying or selling equipment

- Purchasing buildings or land

- Investing in other businesses or assets

Beginner example:

If a company spends $100,000 on new machinery, that cash outflow appears in investing activities. While this reduces cash now, it may support future growth.

Negative investing cash flow is not necessarily bad—it often means the company is investing in its future.

3. Cash Flow From Financing Activities

Financing cash flow shows cash related to funding the business and returning money to investors.

It includes:

- Borrowing or repaying loans

- Issuing or buying back stock

- Paying dividends

Beginner example:

If a company takes out a $200,000 loan, that amount shows as a cash inflow from financing activities. If it later repays $50,000, that repayment appears as a cash outflow.

This section helps investors see how a company finances operations and growth.

A Simple Cash Flow Statement Example

Here’s a simplified example for one year:

Operating activities

- Cash from customers: $600,000

- Cash paid for expenses: $450,000

- Net operating cash flow: $150,000

Investing activities

- Purchase of equipment: -$80,000

Financing activities

- Loan repayment: -$30,000

Net change in cash: $40,000

This example shows a company that generates cash from operations, invests in growth, and manages debt responsibly.

How Investors Use the Cash Flow Statement

Investors analyze cash flow statements to:

- Confirm profits are backed by real cash

- Identify companies relying heavily on debt

- Evaluate sustainability of dividends

- Assess financial resilience during downturns

A company with strong operating cash flow is generally better positioned to survive tough economic conditions.

Positive vs. Negative Cash Flow

Cash flow can be:

- Positive: More cash coming in than going out

- Negative: More cash going out than coming in

Negative cash flow isn’t always bad. Startups and growing companies often invest heavily before becoming cash-flow positive. However, long-term negative operating cash flow can be a warning sign.

Cash Flow Trends Matter More Than One Period

Like other financial statements, cash flow should be analyzed over time.

- Consistently positive operating cash flow is a strong signal

- Improving cash flow may indicate a turnaround

- Declining cash flow can signal growing problems

One bad year doesn’t tell the whole story—patterns matter more.

Cash Flow and Long-Term Investing

For long-term investors, cash flow is often more important than short-term profits. Companies with reliable cash flow can:

- Reinvest in growth

- Pay down debt

- Pay dividends

- Survive economic downturns

Strong cash flow provides flexibility and stability, two qualities investors value highly.

Common Beginner Mistakes

When reading cash flow statements, beginners often:

- Focus only on net income

- Ignore operating cash flow

- Assume negative investing cash flow is bad

- Look at one year instead of long-term trends

Understanding the purpose of each section helps avoid these mistakes.

Tips for Beginners

To start using cash flow statements effectively:

- Focus first on operating cash flow

- Compare cash flow to net income

- Look for consistency over time

- Combine cash flow analysis with income statements and balance sheets

You don’t need to analyze every line item to gain useful insight.

Final Thoughts

The cash flow statement shows a company’s cash inflows and outflows, revealing how money actually moves through the business. By breaking cash activity into operating, investing, and financing sections, it provides a clear view of a company’s financial health and flexibility.

For beginner investors, understanding the cash flow statement is a crucial step toward smarter investing. When combined with the income statement and balance sheet, it helps investors move beyond surface-level profits and evaluate whether a business can truly support long-term growth and financial stability.

One Reply to “Cash Flow Statement: Shows Cash Inflows and Outflows”