Stocks definition A Simple Explanation for Beginners

A stock represents ownership in a company. When you buy a stock, you are buying a small piece of that business, which makes you a shareholder. As a shareholder, you can benefit when the company grows and becomes more valuable.

In the United States, stocks are one of the most popular ways to build long-term wealth, used by individual investors, retirement funds, and large institutions alike.

How Stocks Work in Simple Terms

Imagine a company wants to raise money to grow—maybe to open new stores, build products, or expand into new markets. Instead of borrowing money, the company can sell ownership shares to the public. These shares are called stocks.

Each stock represents a fraction of ownership in the company.

Example:

If a company has 1 million shares outstanding and you own 1,000 shares, you own 0.1% of that company.

Why Companies Issue Stocks

Companies issue stocks mainly to:

- Raise capital for growth

- Pay off debt

- Invest in new projects

- Increase public visibility

When a company first sells its shares to the public, it’s called an Initial Public Offering (IPO). After the IPO, stocks are traded between investors on stock exchanges.

Where Stocks Are Bought and Sold in the US

In the US, stocks are traded on regulated exchanges, such as:

- NYSE (New York Stock Exchange) – Traditional exchange with many large companies

- NASDAQ – Electronic exchange known for technology stocks

Investors buy and sell stocks using brokerage platforms like Fidelity, Charles Schwab, Robinhood, or TD Ameritrade.

How Investors Make Money From Stocks

There are two main ways to make money from stocks:

1️⃣ Price Appreciation

If you buy a stock at a lower price and sell it at a higher price, you make a profit.

Example:

- You buy Apple (AAPL) stock at $150

- Later, you sell it at $180

- Your profit = $30 per share (before taxes and fees)

2️⃣ Dividends

Some companies share part of their profits with shareholders in the form of dividends.

Example:

- Coca-Cola pays quarterly dividends

- If you own 100 shares and the dividend is $0.50 per share

- You earn $50 in dividend income

Dividend-paying stocks are popular among long-term and retirement investors.

Types of Stocks in the US Market

Common Stock

Most stocks are common stocks. They give shareholders:

- Voting rights

- Potential dividends

- Capital appreciation

Preferred Stock

Preferred stock usually offers:

- Fixed dividends

- Priority over common stock in payments

- Usually no voting rights

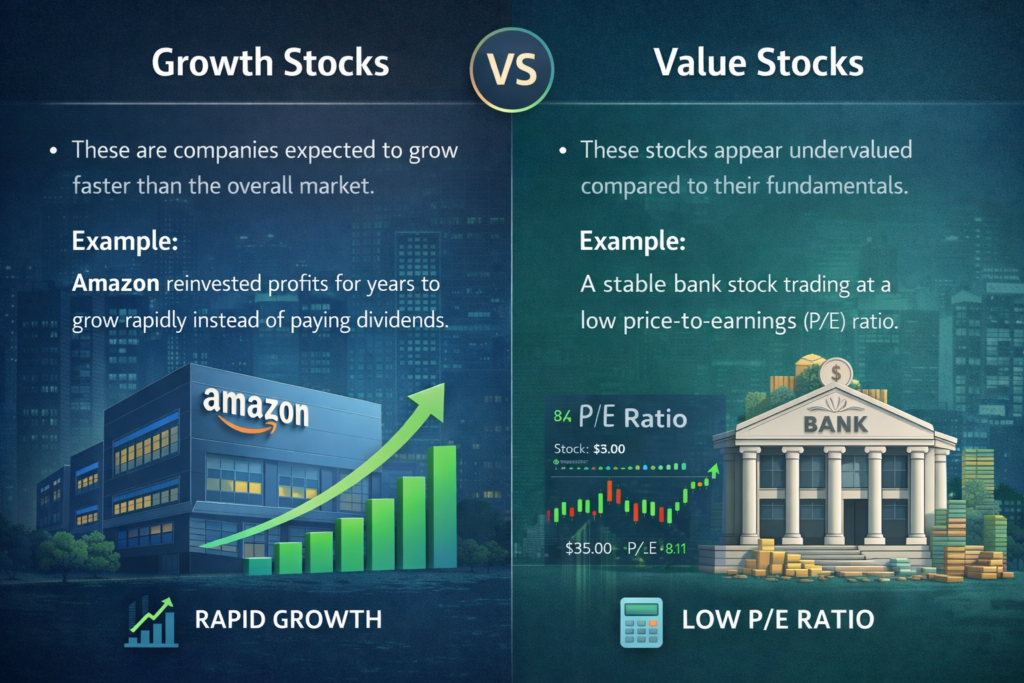

Growth Stocks vs Value Stocks

Growth Stocks

These are companies expected to grow faster than the overall market.

Example:

Amazon reinvested profits for years to grow rapidly instead of paying dividends.

Value Stocks

These stocks appear undervalued compared to their fundamentals.

Example:

A stable bank stock trading at a low price-to-earnings (P/E) ratio.

Why Stock Prices Go Up and Down

Stock prices change based on supply and demand. Factors that influence price include:

- Company earnings

- Revenue growth

- Economic conditions

- Interest rates

- Investor sentiment

- News and expectations

Example:

If a company reports higher-than-expected earnings, more investors may want to buy the stock, pushing the price up.

Risks of Investing in Stocks

Stocks offer high potential returns, but they also come with risks:

- Prices can fluctuate daily

- Companies can underperform

- Market downturns can reduce value

Example:

During economic recessions, stock prices often fall, even for strong companies.

This is why many US investors focus on diversification, spreading money across multiple stocks or funds.

Stocks vs Other Investments

| Investment | Risk | Return Potential | |

| Stocks | Medium to High | High (long-term) | |

| Bonds | Low to Medium | Lower | |

| Savings Accounts | Very Low | Very Low | |

| Real Estate | Medium | Medium to High |

Stocks are especially popular for long-term goals like retirement.

Why Stocks Are Important for Long-Term Wealth

Historically, the US stock market has delivered average annual returns of about 7–10% over long periods. This makes stocks a powerful tool for:

- Retirement planning (401(k), IRA)

- Wealth building

- Beating inflation

Example:

Investing $10,000 in the S&P 500 and holding it for decades has historically grown significantly due to compounding.

Final Thoughts

A stock is more than just a ticker symbol on a screen—it represents real ownership in a real business. When you buy a stock, you are betting on the company’s future success.

For beginners in the US, understanding stocks is the first step toward smart investing. While stocks involve risk, they remain one of the most effective ways to build wealth over time when approached with patience, education, and a long-term mindset.

2 Replies to “Stocks definition, A Simple Explanation for Beginners”