Underlying Asset: The Asset on Which Derivatives are Based

An underlying asset is the foundation of a derivative contract. Simply put, it’s the asset whose price movement determines the value of a derivative. If the underlying asset goes up or down, the derivatives linked to it typically moves as well. Understanding underlying assets is essential for anyone learning about options, futures, and other derivatives—because every derivative starts with something real underneath it.

This beginner-friendly guide explains what an underlying asset is, why it matters, the most common types, and realistic examples you’ll see in everyday finance.

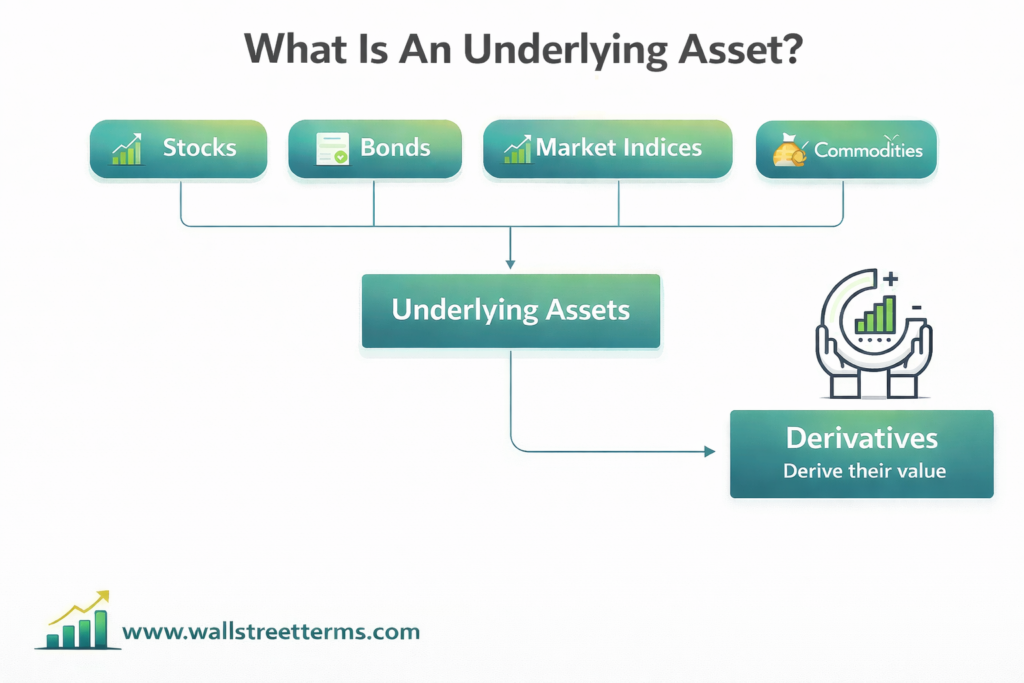

What Is an Underlying Asset?

An underlying asset is the reference asset tied to a derivative contract. The derivatives itself doesn’t have value on its own; its value is derived from the underlying asset’s price, rate, or level.

Common underlying assets include:

- Stocks

- Stock market indexes

- Commodities

- Currencies

- Interest rates

Simple example:

If an options contract is based on shares of Apple Inc., then Apple’s stock price is the underlying asset. When Apple’s stock price changes, the option’s value changes too.

Why the Underlying Asset Matters

The underlying asset matters because it drives:

- Price movement: The derivative’s value rises or falls with the underlying asset.

- Risk: Volatility and uncertainty come from the underlying asset.

- Strategy: How traders use derivatives depends on what the underlying asset is.

Before trading any derivative, experienced investors always ask: What is the underlying asset, and how does it behave?

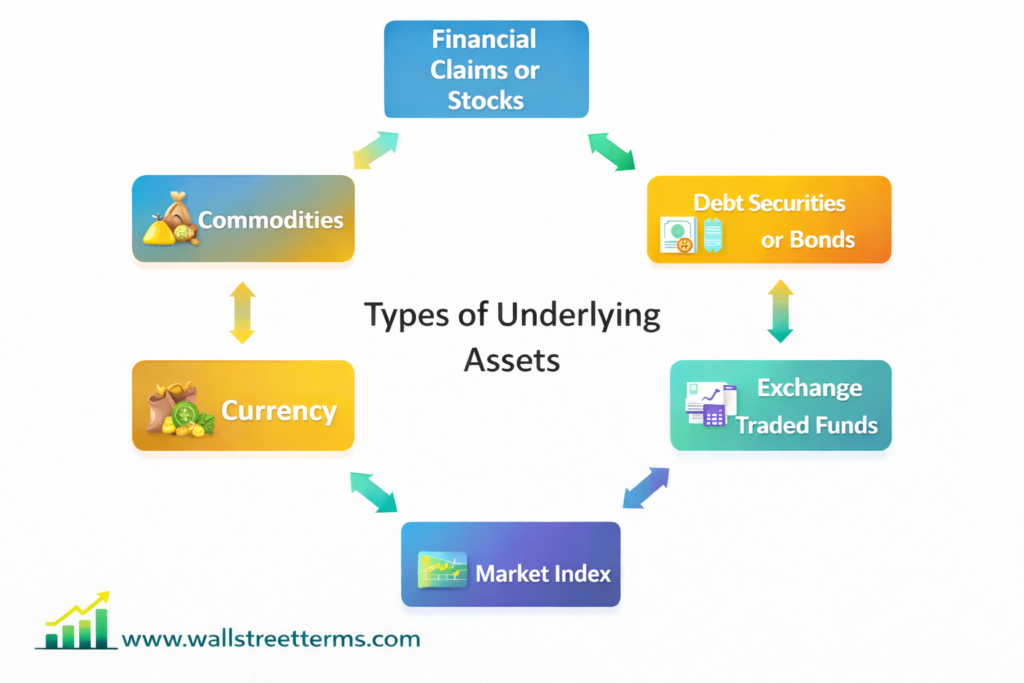

Types of Underlying Assets

Underlying assets come in many forms. Beginners should be familiar with the most common categories.

1. Stocks as Underlying Assets

Individual stocks are among the most common underlying assets.

Example:

A call option on Apple stock gives the holder the right to buy Apple shares at a certain price. The option’s value depends entirely on Apple’s stock performance.

Stock-based underlying assets are popular because:

- Prices are transparent

- Liquidity is high

- Information is widely available

2. Market Indexes as Underlying Assets

Some derivatives are based on entire markets rather than individual companies.

A widely used example is the S&P 500, which represents 500 large U.S. companies.

Why indexes matter:

Index-based underlying assets allow traders to gain exposure to the overall market without picking individual stocks. Options and futures tied to indexes are often used for hedging broad market risk.

3. Commodities as Underlying Assets

Commodities are physical goods such as:

- Crude oil

- Gold

- Wheat

- Natural gas

Realistic example:

An oil futures contract uses crude oil as the underlying asset. If oil prices rise, the value of the futures contract increases.

Commodity underlying assets are widely used by producers and consumers to manage price risk.

4. Currencies as Underlying Assets

Foreign exchange (forex) derivatives use currency pairs as the underlying asset, such as:

- EUR/USD

- USD/JPY

Example:

A U.S. company expecting payment in euros might use a currency derivative to protect against unfavorable exchange rate changes.

Currency underlying assets are especially important in global trade and international investing.

5. Interest Rates and Bonds as Underlying Assets

Some derivatives are based on:

- Interest rates

- Government bonds

- Treasury yields

These underlying assets influence borrowing costs and economic activity. Interest rate derivatives are widely used by banks, corporations, and governments.

How Underlying Assets Affect Derivative Value

The behavior of the underlying asset directly influences how a derivative performs.

Key factors include:

- Price direction: Up, down, or sideways

- Volatility: How much the price fluctuates

- Liquidity: How easily the asset can be traded

- Time: Especially important for options

Beginner example:

An option on a highly volatile stock tends to be more expensive than an option on a stable stock, even if the prices are similar. That’s because volatility in the underlying asset increases potential outcomes.

Underlying Asset vs. Derivative: Key Differences

It’s important not to confuse the two.

| Underlying Asset | Derivative |

| Real asset or benchmark | Financial contract |

| Exists independently | Depends on underlying |

| Can be owned directly | Represents exposure |

You can own shares of Apple stock without trading options, but you cannot trade Apple options without Apple stock being the underlying asset.

Real-World Uses of Underlying Assets

Understanding the underlying asset explains why derivatives are used.

Hedging:

An investor who owns stocks may use index options to protect against market declines.

Speculation:

A trader may use derivatives to profit from short-term price movements in an underlying asset without owning it.

Efficiency:

Derivatives provide exposure to assets that may be expensive or impractical to trade directly.

Risks Related to Underlying Assets

All risks in derivatives ultimately come from the underlying asset.

Common risks include:

- Sudden price swings

- Unexpected news or events

- Low liquidity

- High volatility

If you don’t understand how the underlying asset behaves, the derivative becomes far riskier.

How Beginners Should Approach Underlying Assets

For beginners:

- Start with familiar underlying assets (stocks or indexes)

- Study historical price behavior

- Understand what moves the asset (earnings, interest rates, supply/demand)

- Avoid highly complex or volatile underlying assets early on

Knowledge of the underlying asset matters more than the derivative’s mechanics.

Final Thoughts

An underlying asset is the asset on which a derivative is based—and it is the most important component of any derivative contract. Whether it’s a stock, index, commodity, currency, or interest rate, the underlying asset determines the derivative’s value, risk, and behavior.

For anyone learning about derivatives, mastering the concept of the underlying asset is a critical first step. Once you understand what’s underneath the contract, derivatives become less intimidating and far more logical—opening the door to smarter, more informed financial decisions.

One Reply to “Underlying Asset ? understand in 5 minutes”